A Greek canary in a global goldmine - By Yanis Varoufakis, The Jordan Times

ATHENS — The eurozone country that has become synonymous with insolvency is today proving to be a treasure-trove for some. Traders who bought Greek assets a few years ago have good reason to celebrate, having banked returns that no other market could have provided. But, as is often the case, an opportunity that seems too good to be true probably is. And this one could portend the next phase of our global crisis.

An investor who bought German government bonds in 2013 has, by now, gained a 7 per cent return, whereas a buyer of a Greek government bond issued at the height of the country’s debt crisis in 2012 would have earned a colossal 231 per cent return. Two months ago, the price of the first 10-year bond issued since Greece’s bailout in 2010 surged for seven consecutive days, rising by 2.8 per cent in a week, a better performance than any other government bond issue worldwide. That bond rally created a psychological slipstream, which, in recent months, pulled the Athens Stock Exchange 26 per cent higher, against the background of a European asset market inexorably bleeding capital.

On the strength of these impressive numbers, it is as tempting as it would be false to herald the end of Greece’s crisis. The Greek bond and equity rally is obscuring a growing chasm between a gloomy economic reality and an unsustainably buoyant financial climate. Rather than reflecting Greece’s recovery, the traders’ high profit margins mirror continued deflationary pressures and fragmentation in Europe within a global environment of decreasing debt sustainability. The numbers from Greece, so exciting to investors far and wide, may well prove a harbinger of fresh troubles for Europe’s economy, and perhaps for the world.

Given the gaping gap between Greece’s nominal national income and its public debt, how is it possible that Greek bonds are soaring? Why is the Athens Stock Exchange rising while business remains hampered by punitive taxation, banks labour under a mountain of non-performing loans, declining unemployment reflects only emigration and some precarious jobs, net public investment is negative and private investment in production of high value-added tradable goods is absent?

One reason is the proverbial dead-cat-bounce. Given how thin Greece’s equity market is, total capitalisation is $58 billion, the modest influx of capital that came in the wake of the bond rally was enough to drive the 26 per cent rise in its index. But, despite this surge, the Greek market remains 81 per cent below its 2009 level. As for the bond rally itself, the paradox quickly disappears once we recall how the first two bailouts shifted Greek public debt from the private sector to the shoulders of Europe’s taxpayers.

With 85 per cent of Greece’s debt outside the markets, repayments deferred until after 2032, and another 30 billion euros of official loans extended to the Greek government to cover its repayments to all comers, investors can focus on the small slice of Greece debt that remains in private hands. As long as the Greek government is subservient to Europe’s authorities, traders cannot lose money on bonds it issues at interest rates of more than 3 per cent, at a time when German bund yields are hovering near zero.

Determined to remain upbeat, most commentators point out, for example, that average Greek debt maturity is 26 years, in sharp contrast to seven years for Italy and Spain or 10 years for Portugal, giving Greece’s economy the chance to recover properly. What they neglect to mention are the impossible austerity conditions that Greece’s creditors attached to that extension: a permanent primary budget surplus (excluding debt repayment) of 2.2-3.5 per cent of GDP until 2060. In other words, Greek businesses will have to continue paying 75 per cent of their profits to the government, including social security contributions, on average, while the total tax burden in neighboring Bulgaria is no more than 22 per cent.

In short, Greece has gone from being Ground Zero of the eurozone crisis, and the best example of its mismanagement by the EU authorities, to a perfect example of how financial exuberance can ride on the back of economic misery. This disparity’s most worrying aspect is that profit-driven traders are not wrong to snap up the paper assets of a sinking country. From their short-term perspective, it is an irresistible play, and their bottom line confirms this. But it is wrong, even reckless, to conclude that, because traders are making a mint with Greek assets, the underlying reality must be improving.

The rest of the world would benefit from viewing this disconnect as a symptom of a global predicament. In June 2017, Argentina issued a 100-year bond worth $2.75 billion that sold like hot cakes on the strength of great, and greatly mistaken, expectations of the Argentine economy’s prospects under a new neoliberal administration. While those trades have already proved foolhardy, there is hard evidence that average total returns to investors are higher when they buy the debt of countries that default more frequently. But financiers’ penchant for investing in low-quality debt and talking up non-existent opportunities is most dangerous when applied to private, as opposed to public, debt.

During the first three months of this year, a stupendous 40 per cent of all loans to highly indebted companies in the United States went to the least solvent. According to the Federal Reserve, this over-leveraged lending increased 20.1 per cent in 2018, while other sources report a deterioration in underwriting standards. Credit is being channeled to low-rated, heavily indebted companies, overshadowing the safer high-yield bond market as a source of financing. According to LCD, a division of S&P Global Market Intelligence, the leveraged loan market has now exceeded $1.2 trillion, overtaking traditional junk bonds and undermining less risky covered bonds.

Greece is in the vanguard of this trend, attracting fair-weather, shallow, speculative trades, while patient investment in its economic recovery is nowhere to be seen. After 2008, Greece came to symbolise global capitalism’s failure to balance credit and trade flows. Today, as the global mismatch between economic reality and financial returns grows, there is clear danger that, once again, the country is foreshadowing a new phase of the global crisis. When vultures grow fat on a corpse, they do not revive it.

Latest News

Safadi, Iranian counterpart discuss war on Gaza, regional escalation

Safadi, Iranian counterpart discuss war on Gaza, regional escalation US vetoes Security Council resolution on full Palestinian UN membership

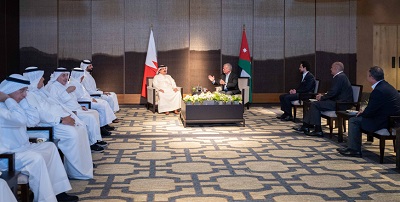

US vetoes Security Council resolution on full Palestinian UN membership King, Bahrain monarch stress need to maintain Arab coordination

King, Bahrain monarch stress need to maintain Arab coordination Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership Dubai reels from floods chaos after record rains

Dubai reels from floods chaos after record rains

Most Read Articles

- Jordan urges UN to recognise Palestine as state

- Senate president, British ambassador discuss strategic partnership, regional stability

- JAF carries out seven more airdrops of aid into Gaza

- Temperatures to near 40 degree mark next week in Jordan

- Safadi, Iranian counterpart discuss war on Gaza, regional escalation

- US vetoes Security Council resolution on full Palestinian UN membership

- UN chief warns Mideast on brink of ‘full-scale regional conflict’

- Biden urges Congress to pass 'pivotal' Ukraine, Israel war aid

- Google fires 28 employees for protesting $1.2 billion cloud deal with “Israeli” army

- Israeli Occupation strike inside Iran responds to Tehran's provocation, reports say