Does the US want high or low oil prices? - By Omar Al-Ubaydli, Alarabiya

The US economy has traditionally been a heavy importer of oil, making it unquestionably a fan of low oil prices. Meanwhile, the shale oil revolution has transformed the US oil industry, and driven net imports to almost zero. But, has that been enough to make America favor high oil prices, and to be an OPEC ally?

In 1975, two years after the OPEC embargo, the US banned petroleum exports to ensure sufficient local supplies of the strategic, important commodity. At that time, net oil imports equaled six million barrels/day, a figure that grew to 13.5 million in 2006 in light of the economy’s sustained growth. Ensuring a reliable flow of oil for its economy, and for those of its economic partners, such as China and Japan, became a central tenet of US foreign policy, and a key reason for its heavy military involvement in the Middle East.

OPEC's ill-deserved reputation

At the same time, OPEC was building a reputation for restricting output, and raising global oil prices to the benefit of its members. This earned the group supervillain status among all segments of US society, due to the importance of gasoline prices to US household budgets.

In fact, based on a detailed analysis of oil production data for both OPEC members and non-members, Jeff Colgan of Brown University convincingly demonstrated that throughout the period of 1980-2009, OPEC’s reputation as a cartel was ill-deserved. With the exception of Saudi Arabia, the oil production strategies of the club’s members were identical to those of non-members. The reason for the myth’s persistence was that OPEC’s members enjoyed cultivating a reputation as bulwarks against western imperialism, while western leaders welcomed a willing scapegoat for their domestic economic woes.

In the early 2000s, as petroleum extraction technology advanced, US shale oil began to satisfy local demand, and in 2015, the industry’s renaissance had become strong enough for Congress to lift the 40-year-old export ban. By 2018, US net imports had fallen to 1.4 million barrels per day. With revenues, profits, and employment in the oil sector burgeoning, part of US society finally had an explicit preference for high oil prices, and this came to the fore in the wake of the 2014 oil-price crash, when many shale producers faced bankruptcy. The diminished importance of oil imports also became a central reason for the US’ “pivot to Asia”, and its reduced military interventionism in the Middle East.

In parallel to the transformations in the US oil sector, in December 2016, OPEC finally went from pseudo price-raiser to actual price-raiser, when a surprising deal with OPEC non-members, led by Russia, was secured. That deal has continued, driven by Russia’s desire to forge stronger geo-political ties with Saudi Arabia. US shale oil producers breathed a sigh of relief, as the increase in prices provided the industry with a much needed revenues boost.

But the US is much more than oil producers. Amidst the hysteria surrounding the 2014 oil-price crash, a segment of the media began attributing the decline in prices to Saudi Arabia, despite the fact that Saudi Arabia’s output was essentially fixed throughout the episode, and that the Kingdom continued to operate below capacity. Moreover, a popular theory emerged that Saudi Arabia was flooding the market in an attempt to knock out shale oil, despite the theory clearly being falsified by even a cursory look at the production data. As a result, a group of US Congress people threatened legal action against Saudi Arabia, accusing it of employing predatory pricing against US producers. Apparently, the US actually wanted high prices!

Until 2018, however, ahead of the midterm elections, Congress worried about the impact of higher gasoline prices on their constituents, and launched legal proceedings against Saudi Arabia and the rest of OPEC, accusing them of colluding to raise prices. After this, it was apparent the US now wanted low prices.

So what does the US actually want? Well, there seems to be a consensus among US policymakers that a thriving domestic oil industry is desirable, as evidenced by the ease with which oil producers have been able to overcome opponents, citing either environmental concerns, or trying to defend territories owned by Native Americans. This is partially due to the direct economic return from exploiting an available natural resource; as well as reflecting a desire for self-sufficiency, stemming from the US’ tilt toward economic and diplomatic isolationism.

But a large segment of society remains averse to higher oil prices, and still associates them with OPEC, whatever the actual cause. OPEC members may now regret their previous willingness to play the role of scapegoat in the eyes of the US public.

So which force dominates? The US political system is genuinely pluralistic, meaning that there is little sense in imagining an integrated US viewpoint. As Donald Trump is learning, Congress and the White House can have wildly divergent policy positions, while organs such as the State Department, the Department of Defense, and the individual state governments all have their own stances and wield significant authority. The contradictions can even be observed at the level of individuals, as a typical rural Republican voter simultaneously demands prices low enough to raise their standard of living, but high enough to promote US self-sufficiency in energy markets. Either way, OPEC strategists have a tough job on their hands.

Latest News

Jordan urges UN to recognise Palestine as state

Jordan urges UN to recognise Palestine as state Safadi, Iranian counterpart discuss war on Gaza, regional escalation

Safadi, Iranian counterpart discuss war on Gaza, regional escalation US vetoes Security Council resolution on full Palestinian UN membership

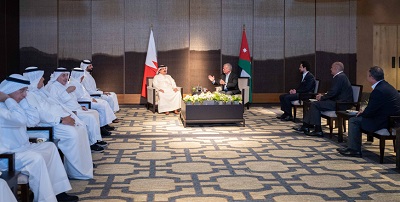

US vetoes Security Council resolution on full Palestinian UN membership King, Bahrain monarch stress need to maintain Arab coordination

King, Bahrain monarch stress need to maintain Arab coordination Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership

Most Read Articles

- Jordan urges UN to recognise Palestine as state

- Senate president, British ambassador discuss strategic partnership, regional stability

- JAF carries out seven more airdrops of aid into Gaza

- Temperatures to near 40 degree mark next week in Jordan

- Safadi, Iranian counterpart discuss war on Gaza, regional escalation

- US vetoes Security Council resolution on full Palestinian UN membership

- UN chief warns Mideast on brink of ‘full-scale regional conflict’

- Biden urges Congress to pass 'pivotal' Ukraine, Israel war aid

- Google fires 28 employees for protesting $1.2 billion cloud deal with “Israeli” army

- Israeli Occupation strike inside Iran responds to Tehran's provocation, reports say