Stocks bound higher on recovery hopes

AFP

LONDON — Stocks markets on both sides of the Atlantic pushed into record territory on Tuesday on growing confidence in the global economic recovery from the Covid pandemic.

A rally in equities across the world over the past months appeared to have run out of steam on concerns about a rise in interest rates, but those worries were pushed to the background on Tuesday as yields on US government bonds retreated.

"The dip in government bond yields has acted as the green light for the equity bulls," said David Madden at CMC Markets UK.

On Wall Street, the Dow came within striking distance of its all-time high set last month and could close at a record level.

Meanwhile, Frankfurt's DAX closed at a record high for a second straight day.

"The positive mood is being fuelled by the hopes the US government will implement the $1.9 trillion relief package soon," added Madden.

The package is on track to be signed by US President Joe Biden this week.

Sentiment was also boosted by the Organisation for Economic Co-operation and Development sharply raising its 2021 global growth forecast as the deployment of vaccines and a huge US stimulus programme have greatly improved economic prospects.

Concerning inflation, the organisation said underlying price pressures generally remain mild and are being held in check by ample spare capacity around the world.

Next week's US Federal Reserve policy meeting will be pored over for signs of change in its outlook for interest rates and its huge bond-buying scheme, with Biden's stimulus likely to have been signed by then.

A rise in benchmark US Treasury yields in recent weeks has been fuelled by investors moving out of the haven assets, betting that a rise in inflation will eat into their returns.

Fears of higher rates has in particular hit US tech stocks hard, with the Nasdaq Composite having entered correction territory by falling more than 10 per cent from the record high it set last month.

However, the Nasdaq rebounded sharply on Tuesday, jumping 3.6 per cent in late morning trading.

Oil prices rose and then fell back, a day after Brent briefly shot above $71 per barrel following a drone attack on Saudi oil facilities, with the main international contract slumping below $68.

"Today's choppy trade could reflect hesitancy to have a big position before the EIA weekly crude oil inventory report," said analyst Edward Moya at currency trading platform Oanda, referring to the weekly US government data on the market.

"Energy traders will want to closely watch how strong US production can bounce back and if that poses a risk for OPEC+'s hesitancy to raise output," he added.

Last week, OPEC and its allies held back on most of its scheduled production cuts despite indications of greater demand as vaccination campaigns in the US and elsewhere help economies get back to work.

Latest News

Safadi, Iranian counterpart discuss war on Gaza, regional escalation

Safadi, Iranian counterpart discuss war on Gaza, regional escalation US vetoes Security Council resolution on full Palestinian UN membership

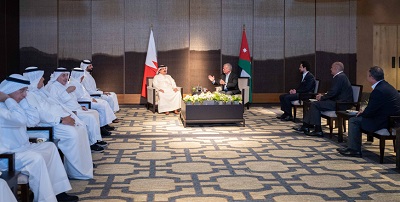

US vetoes Security Council resolution on full Palestinian UN membership King, Bahrain monarch stress need to maintain Arab coordination

King, Bahrain monarch stress need to maintain Arab coordination Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership Dubai reels from floods chaos after record rains

Dubai reels from floods chaos after record rains

Most Read Articles

- Jordan urges UN to recognise Palestine as state

- Senate president, British ambassador discuss strategic partnership, regional stability

- Temperatures to near 40 degree mark next week in Jordan

- JAF carries out seven more airdrops of aid into Gaza

- Safadi, Iranian counterpart discuss war on Gaza, regional escalation

- US vetoes Security Council resolution on full Palestinian UN membership

- UN chief warns Mideast on brink of ‘full-scale regional conflict’

- Biden urges Congress to pass 'pivotal' Ukraine, Israel war aid

- Google fires 28 employees for protesting $1.2 billion cloud deal with “Israeli” army

- Israeli Occupation strike inside Iran responds to Tehran's provocation, reports say