Economy might benefit from eurozone recovery — WB

The Jordan Times

AMMAN — Jordan’s economic growth is forecasted to edge up to 2.5 per cent by 2020 after suffering a slowdown by 0.3 per cent in the past two years, according to the 2018 Global Economic Prospects report released by the World Bank on Tuesday.

The study, titled “Broad-based upturn, but for how long?”, cites Jordan among the many commodity importers in Europe, Central Asia and the Middle East and North Africa (MENA) region which have enjoyed positive trade and financial spillovers from strengthening activity in the Euro area and the recovery in Russia.

“A stronger-than-expected economic recovery in the euro area would provide an important support to growth in the MENA region,” the report said, noting that several countries in the region including Jordan are “dependent on remittances and foreign direct investment”.

“The stability in the eurozone will be reflected in Jordan both in terms of aid and new investments,” economist Wajdi Makhamreh told The Jordan Times, highlighting “the facilities that Jordan is gaining lately regarding the exports to the European Union”.

In addition, the study highlighted the measures taken by Jordan amongst other developing countries in order to avoid energy subsidies reemerging if oil prices rebound, with automatic pricing mechanisms or full energy price liberalisation taking place in several nations.

“Jordan is now focusing on renewable energies and that will soon start cutting some costs,” Makhamreh said, stressing that “the economic plan announced last year is starting to show positive results”.

However, the report referred to the refugee crisis as the onset of macroeconomic challenges in the Kingdom and other host countries, whilst also amplifying “fundamental development challenges in education, health, jobs, water, and livelihood for refugees, such as through expansion of health service delivery”.

Commenting, Makhamreh explained that “if the political settlement in Syria continues part of the refugees will go back to their homes, which will ease the burden on the government’s budget in the following years.”

The prospects are also positive from the regional perspective, with economic growth in the MENA region expected to accelerate to 3.2 per cent in 2019 given a moderation of the geopolitical tensions and a modest rise in oil prices.

For his part, economist Hosam Ayesh remarked that “the economic growth is dependent on external factors rather than the internal”, noting that “expatriate remittances are expected to decline after the return of some expatriates in the Gulf, which will raise the unemployment rate to 18 per cent”.

The forecast appears positive when compared to the previous years, with growth in the region estimated to have decreased sharply to 1.8 per cent in the past year due to “the slowdown in growth among oil exporters driven by oil production cuts and continued geopolitical tensions, which has more than offset a pickup among oil-importing economies,” according to the report.

“Risks to growth in the region vary across oil exporters and importers, but are generally tilted to the downside,” the study continued, warning that “geopolitical risks remain elevated, and are complicated by intra-regional diplomatic tensions”.

In addition, the Gulf Cooperation Council economies are anticipated to lead stronger growth in the region supported by easing fiscal adjustment, infrastructure investment such as the UAE Expo 2020, and reforms to promote non-oil sector activity.

Regarding the worldwide perspective, the report found that the global economy is experiencing a broad-based cyclical upturn, expected to be sustained over the next couple of years with downside risks.

“In contrast, growth in potential output is flagging, languishing below its longer-term and pre-crisis average both globally and among emerging market and developing economies,” the report pointed out, noting that “the forces depressing potential output growth will continue unless countered by structural policies”.

Latest News

Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership Dubai reels from floods chaos after record rains

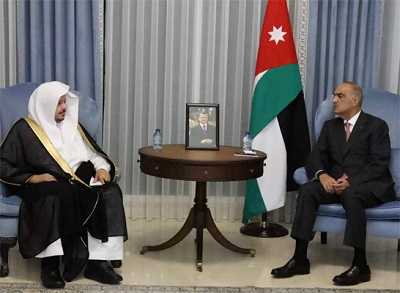

Dubai reels from floods chaos after record rains Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime' Travelers from Jordan advised to confirm flights amid Gulf weather turmoil

Travelers from Jordan advised to confirm flights amid Gulf weather turmoil

Most Read Articles

- King, Bahrain monarch stress need to maintain Arab coordination

- Dubai reels from floods chaos after record rains

- Security Council to vote Thursday on Palestinian state UN membership

- Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

- Tesla asks shareholders to reapprove huge Musk pay deal

- Jordan will take down any projectiles threatening its people, sovereignty — Safadi

- Hizbollah says struck Israel base in retaliation for fighters' killing

- Princess Basma checks on patients receiving treatments

- Knights of Change launches nationwide blood donation campaign for Gaza

- The mystery of US interest rates - By The mystery of US interest rates, The Jordan Times