Endeavor Catalyst closes Fund III at $134m with participation from ISSF

The Jordan Times

AMMAN — Endeavor Catalyst closed its 3rd Fund “Endeavor Catalyst III” with $134 million, of which $2 million came from Jordan’s Innovative Startups and SMEs Fund (ISSF), and $1.7 million from other Jordanian Limited Partners (LPs), Endeavor Catalyst’s Managing Director, Allen Taylor has announced.

Having invested earlier in four Jordanian companies — Kharabeesh, Altibbi, Mawdoo3 and Jamalon — Endeavor Catalyst is an innovative, rule-based co-investment fund through which investments are made in portfolio companies led by high-impact entrepreneurs around the world, according to a statement from Endeavor Catalyst.

Launched in 2012, Endeavor Catalyst has raised $250 million across three funds and made 150+ investments to date across 30+ different markets, the statement said.

Laith Al Qasem, CEO of the ISSF commented on the investment: “ISSF is very excited about this investment. Strategically, Endeavor Catalyst will showcase Jordanian scale-ups at a global level. Practically, Endeavor provides Jordanian companies with access to global markets, capital and remarkable mentors, ultimately setting up Jordanian scale-ups for global success.”

Managing Director of Endeavor Jordan, Reem Goussous added: “We are extremely grateful to the contribution of the ISSF and the LPs in this 3rd fund, which will go towards investing in Jordanian scale-ups”.

Goussous added that the ISSF and local Jordanian LPs are now among a line-up of iconic global founders like Reid Hoffman (LinkedIn), Michael Dell (Dell Technologies), and Pierre Omidyar (eBay), as well as world-class investors such as General Atlantic’s Bill Ford and Pershing Square’s Bill Ackman.

With deep-experience mentoring and coaching by entrepreneurs who know the “ins and outs” of navigating the venture capital fundraising process, Endeavor Catalyst partners with Endeavor Entrepreneurs on their equity fundraising rounds.

This $134 million fund represents the largest Endeavor Catalyst fund to date, surpassing the $120 million target goal originally set, according to the statement.

It also brings Endeavor Catalyst’s total assets under management (“AUM”) up to $250 million.

The support of LPs to the company enables the organisation to focus on investing in the next generation of founders in emerging and underserved markets around the world, concluded the statement.

Latest News

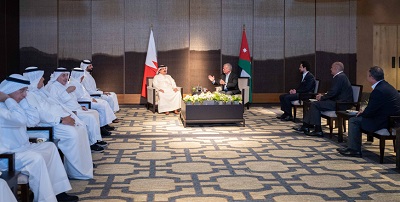

King, Bahrain monarch stress need to maintain Arab coordination

King, Bahrain monarch stress need to maintain Arab coordination Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership Dubai reels from floods chaos after record rains

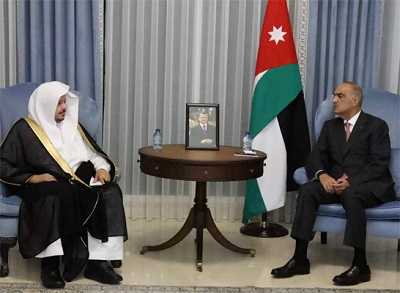

Dubai reels from floods chaos after record rains Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Most Read Articles

- Senate president, British ambassador discuss strategic partnership, regional stability

- Jordan urges UN to recognise Palestine as state

- JAF carries out seven more airdrops of aid into Gaza

- Temperatures to near 40 degree mark next week in Jordan

- Safadi, Iranian counterpart discuss war on Gaza, regional escalation

- UN chief warns Mideast on brink of ‘full-scale regional conflict’

- US vetoes Security Council resolution on full Palestinian UN membership

- Google fires 28 employees for protesting $1.2 billion cloud deal with “Israeli” army

- Biden urges Congress to pass 'pivotal' Ukraine, Israel war aid

- Israeli Occupation strike inside Iran responds to Tehran's provocation, reports say