China-USA trade war: August trial balloons going nowhere - By Dr. Mohamed A. Ramady, Alarabiya

Recent headlines were dominated by the tough rhetoric and aggressive Chinese official media editorials that included vows to dig in for a protracted trade war with the US, even at the expense of the country’s short term economic interests if need be. But through the tough rhetoric, Beijing remained keen on de-escalating the trade war with the US and was looking to float a proposal that could give Trump a valuable, even if partial, political victory on trade before the November mid-term elections. The president desperately needs this given the inroads that the Democratic Party is making.

Beijing may be ready to provide assurances, one more time, that it will reduce the total trade surplus with the US by an agreed amount. But any agreement from Beijing would not include concessions on China’s strategic drive towards dominance in technologies including robotics, artificial intelligence, and 5G telecommunications networks. This the Trump administration might find hard to swallow.

Some believe that this new Chinese offer was nothing more for the moment than a trial balloon to feel the Trump Administration out. With November US elections in mind, Beijing felt the time may be ripe, perhaps by the middle or end of August, to give it another try. But the opposite has been the American reaction - President Trump chose to go and imposed tariffs on the next $200 billion tranche of imports from China, with China’s Central Financial and Economic Affairs Commission responding by agreeing on a series of measures in response.

Those would include retaliatory tariffs, at four different rates, on $60 billion of imports from the US, as well as the active targeting of “less cooperative” American companies operating in China, in attempts to further drive a wedge between corporate America, Congress, and President Trump.

The Chinese seemed to be at a quandary. If assurances from Beijing that it will reduce the trade surplus with the US by an agreed amount may seem awfully similar to a proposal that was floated earlier in May of this year to reduce China’s surplus by $200 billion - and rejected at the time for being too vague and incomplete – it is. The new trial balloons had taken US domestic politics into consideration. The assumption in Beijing was that as the calendar approaches the November mid-term elections, the Trump White House, looking to latch onto a trade victory, could now be more open to taking some “wins,” even if incomplete, while leaving a host of unresolved items open to be settled later.

In the process that partial win would leave some of the thornier - yet politically popular – IP and technology transfer battles alive through the second half of President Trump’s term. And even while the President – and his economic advisors - continue to relish in their fight with China, invoking the strong hand of the US at campaign rallies around the Midwest, many Republican Congressional candidates up for re-election are far less sanguine.

In the meantime, Beijing will continue to refuse to concede - even as it reaches out - that it is responding to pressure, or to any signs of weakness in the economy or markets. President Xi will be portrayed as simply playing along with a Trump negotiating tactic template that has been seen already in the North Korea nuclear negotiations, and then again in the EU trade talks, where Trump, it will be said, “manufactures a crisis,” and then stages a dramatic resolution that changes nothing. Even more, claims will be made that beyond the immediate threats, Trump‘s policies are actually good for China’s strategic interests - to wit his pulling out of the Trans-Pacific Partnership trade negotiations that had excluded China, his singling out of Japan, and his clear desire to withdraw troops from the Korean peninsula.

Asian sphere of influence

Like the North Koreans, when Trump signals he is ready to move, China will then make a major "concession" in the trade negotiations, giving Trump a pre-midterm "victory" on trade – be it out of pressure, or clever negotiations. In the meantime, the Chinese had a raft of their own countermeasures which included the imposition of immediate tariffs, at four different rates, on 5,207 items of US imports worth $60 billion, as well as targeted efforts to drive a wedge between US companies that cooperate with Beijing, and those that do not. In a clever move to optimise on some American companies discomfort with these expanding trade wars, the Chinese government has let it be known that it welcomes and continues supporting American companies that are friendly to China, whereby they adhere to China’s industrial policies, and oppose Trump’s trade protectionism.

But there is also a Chinese stick. On the other hand, the government will strengthen supervision over, and block the expansion of American companies operating in China that have complained to the US government over technology transfers and the theft of intellectual property by China, while “failing” to have ever informed Chinese authorities of such transgressions.

As for Asian sphere of influence and positioning China against the United States in the future, the Chinese have made their intentions very clear by willing to take a leadership role towards meeting an extremely ambitious timetable for signing by year-end a Regional Comprehensive Economic Partnership (RCEP) that is being negotiated between sixteen Asian countries. Representing half the world’s population - China, all ten ASEAN countries, plus Japan, South Korea, India, Australia, and New Zealand - the 16 nation RCEP discussions were initiated as a regional alternative to the Trans-Pacific Partnership (TPP) trade agreement that was scuppered last year by the Trump administration, and pointedly this time around includes China, but not the United States. The question for the Middle East and Gulf countries, is on whose tailcoat they want to ride in the future?

Latest News

Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership Dubai reels from floods chaos after record rains

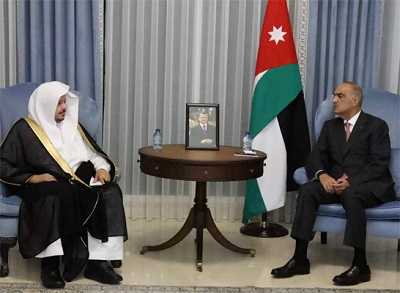

Dubai reels from floods chaos after record rains Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime' Travelers from Jordan advised to confirm flights amid Gulf weather turmoil

Travelers from Jordan advised to confirm flights amid Gulf weather turmoil

Most Read Articles

- King, Bahrain monarch stress need to maintain Arab coordination

- Dubai reels from floods chaos after record rains

- Security Council to vote Thursday on Palestinian state UN membership

- Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

- Tesla asks shareholders to reapprove huge Musk pay deal

- Jordan will take down any projectiles threatening its people, sovereignty — Safadi

- Hizbollah says struck Israel base in retaliation for fighters' killing

- Princess Basma checks on patients receiving treatments

- Knights of Change launches nationwide blood donation campaign for Gaza

- The mystery of US interest rates - By The mystery of US interest rates, The Jordan Times