Razzaz discusses government’s priorities, income tax bill with ICT sector

The Jordan Times

AMMAN — Exemptions and any other details should not all be included in the Income Tax Law but spread among stable by-laws that are not affected by governments' change, Prime Minister Omar Razzaz said on Sunday.

The premier's remarks came during a meeting with the Information and Communications Technology Association, where he added that the recently announced manifesto of the government's priorities for 2019 and 2020 is "the first phase of a larger national project seeking to meet Jordanians' ambitions for a better future", the Jordan News Agency, Petra, reported.

Razzaz stressed that the implementation of the priorities which focused on the country’s productivity, the state of law and solidarity, requires the support of the ICT sector, especially in aspects related to accountability, fighting administrative bureaucracy, billing, tax evasion, goods exportation, e-services and other measures that need automation, Petra said.

Citing the importance of the ICT sector and its contributions to the national economy, Razzaz said that the new income tax law grants exemptions for the capital profits of start-ups for 15 years from the date of their establishment, in addition to decreasing income tax on the sector from 20 per cent to 5 per cent, according to Petra.

Latest News

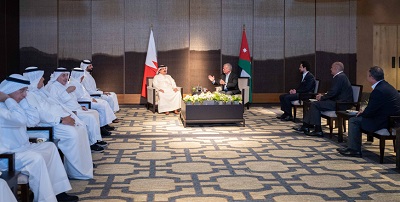

King, Bahrain monarch stress need to maintain Arab coordination

King, Bahrain monarch stress need to maintain Arab coordination Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership Dubai reels from floods chaos after record rains

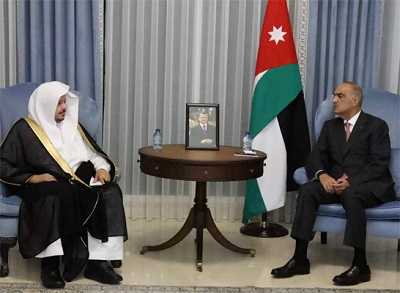

Dubai reels from floods chaos after record rains Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Most Read Articles

- King, Bahrain monarch stress need to maintain Arab coordination

- Dubai reels from floods chaos after record rains

- Security Council to vote Thursday on Palestinian state UN membership

- Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

- Tesla asks shareholders to reapprove huge Musk pay deal

- Jordan will take down any projectiles threatening its people, sovereignty — Safadi

- Hizbollah says struck Israel base in retaliation for fighters' killing

- Knights of Change launches nationwide blood donation campaign for Gaza

- Princess Basma checks on patients receiving treatments

- The mystery of US interest rates - By The mystery of US interest rates, The Jordan Times