‘Over 200 startups to benefit from early stage financing’

The Jordan Times

AMMAN — The World Bank (WB) on Friday announced a new project to promote entrepreneurship in Jordan by providing early stage financing to the small- and medium-sized enterprises (SMEs) that have proven to be the “engines” of job creation, a WB statement said.

The new $50-million project aims to support over 200 innovative startups across the country, with the establishment of a private sector-managed funding facility, according to the statement.

The Innovative

Startups Fund Project will help launch the “Innovative Startups and SMEs Fund” (ISSF).

The $50-million investment from the WB will be complemented by $49-million in co-financing from the Central Bank of Jordan, bringing the total working capital of the ISSF to $99 million, according to the statement.

Along with providing early stage financing, the ISFF will encourage entrepreneurship with outreach to entrepreneurs from remote regions, underserved industries and underserved groups such as women entrepreneurs, the statement added.

“Jordan’s business ecosystem is relatively well developed. There is no lack of innovative and creative ideas,” said Kanthan Shankar, acting director of the World Bank Middle East department.

“However, startup creation is low due to some barriers in the business environment and access to finance. This project puts in practice the very first recommendation of the Jordanian Economic Policy Council to set up a fund to facilitate financing to innovative startups and SMEs in an effort to increase the level of startups with high-growth potential,” he noted.

The fund is expected to invest $50 million in approximately 200 Jordanian companies and provide around $3.5 million in investment support to partner investors, according to the WB.

Investments in startups will be balanced between the three high risk enterprise stages categorised as: seed; early stage; and venture capital.

Investments will be directed across all sectors, with a special focus on technology, media, telecommunications, service and in the agribusiness, pharmaceuticals, water, and green energy sectors, the statement said.

“One of the main reasons that discourages an investor from taking a stake in an early-stage company is the high transaction costs incurred to help make a young innovative company successful once it receives capital,” said Randa Akeel, senior financial sector economist and task team leader.

“Evidence from similar World Bank projects in the region and elsewhere has shown that private investors can be attracted to contribute capital to companies that are at an earlier stage if they can share the risk and expand their portfolio,” he concluded.

Latest News

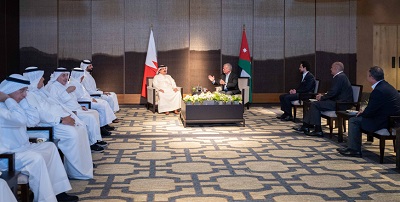

King, Bahrain monarch stress need to maintain Arab coordination

King, Bahrain monarch stress need to maintain Arab coordination Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership Dubai reels from floods chaos after record rains

Dubai reels from floods chaos after record rains Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Most Read Articles

- Senate president, British ambassador discuss strategic partnership, regional stability

- Jordan urges UN to recognise Palestine as state

- JAF carries out seven more airdrops of aid into Gaza

- Temperatures to near 40 degree mark next week in Jordan

- Safadi, Iranian counterpart discuss war on Gaza, regional escalation

- UN chief warns Mideast on brink of ‘full-scale regional conflict’

- US vetoes Security Council resolution on full Palestinian UN membership

- Google fires 28 employees for protesting $1.2 billion cloud deal with “Israeli” army

- Biden urges Congress to pass 'pivotal' Ukraine, Israel war aid

- Israeli Occupation strike inside Iran responds to Tehran's provocation, reports say