Oil steady as Asian states seek to offset coronavirus hit to economies

AFP

Oil steadied near $57 a barrel in London as China and other Asian states promised economic stimulus to offset the impact of the coronavirus, buoying the outlook for fuel demand.

Prices recovered more than 5 percent last week, the biggest gain since September, as some of the fears over how far the infection will hurt the global economy abated. China, Hong Kong and Singapore have pledged extra fiscal stimulus to counter the economic hit from the disease, with Beijing considering measures such as lowering corporate taxes.

Read: Oil prices plunge as coronavirus fears drive markets

Brent for April settlement rose 1 cent to $57.33 a barrel as of 10:39 a.m. in London on the ICE Futures Europe exchange. West Texas Intermediate crude for March delivery added 6 cents to $52.11 a barrel on the New York Mercantile Exchange, after adding 3.4 percent last week, the biggest weekly gain since December.

“Oil appears to have finally shaken off its bearish malaise,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. “Investors cheered a salvo of stimulus measures from China’s central bank aimed to mitigating the economic impact.”

Read: OPEC cuts 2020 forecast for global oil demand due to coronavirus outbreak

China on Monday offered more funding to banks and cut the interest rate it charges for the money. Singapore has also promised a “strong package of budget measures” and central banks in the Philippines, Thailand and Malaysia have cut interest rates as Asian economies grapple with the virus-induced slowdown.

That’s offsetting any disappointment that OPEC and its partners have apparently dropped any plans for an emergency meeting to respond to the crisis. Russia, a pivotal member of the alliance known as OPEC+, has so far resisted a push by Saudi Arabia to launch fresh production cuts in response to the loss of demand.

Traders are now likely to focus on whether the coalition announces new cutbacks at its scheduled meeting on March 5 to 6. A technical committee representing the producers recommended earlier this month that they should reduce supply by a further 600,000 barrels a day, on top of current curbs.

Concerns over the impact of the virus remain strong as Hubei, the Chinese province at the epicenter of the outbreak, reporting new cases and additional deaths. Global oil demand is expected to decline this quarter for the first time in more than a decade, according to the International Energy Agency. Goldman Sachs Group Inc. slashed its 2020 crude-demand forecast almost in half and lowered its first-quarter price estimate by $10 a barrel.

Latest News

King orders holding parliamentary elections in accordance with law, checks on electoral commission’s preparations

King orders holding parliamentary elections in accordance with law, checks on electoral commission’s preparations US Senate passes bill for aid to Israeli Occupation, Ukraine, Taiwan

US Senate passes bill for aid to Israeli Occupation, Ukraine, Taiwan Safadi discusses support to Syrian refugee with DRC

Safadi discusses support to Syrian refugee with DRC Israeli Occupation aggression on Gaza enters 200th day

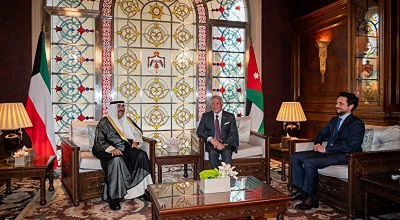

Israeli Occupation aggression on Gaza enters 200th day King, Kuwait emir reaffirm pride in deep-rooted relations

King, Kuwait emir reaffirm pride in deep-rooted relations

Most Read Articles

- Safadi discusses support to Syrian refugee with DRC

- King, Kuwait emir reaffirm pride in deep-rooted relations

- Israeli Occupation aggression on Gaza enters 200th day

- Jordan condemns Israeli 'war crimes' in Gaza, calls for accountability

- UNRWA’s role in Gaza indispensable — Foreign Ministry

- Baby delivered from dying mother's womb in Gaza 'miracle'

- General Motors lifts 2024 profit forecast after strong Q1

- Kuwait channels $24 billion in development assistance to Jordan in 24 years

- King orders holding parliamentary elections in accordance with law, checks on electoral commission’s preparations

- Azerbaijan says ‘closer than ever’ to Armenia peace deal amid border talks