Will floating Egypt’s currency boost its economy? - By Mohammed Nosseir, Al Arabiya

“It’s time to invest in Egypt” is the explicit message that the Egyptian government is attempting to send out to the world following its bold decision to float the Egyptian pound. Being the first and the only Arab country to float its currency gives us an advantage over our competitors in the region. Yet the move, in itself, is certainly not quite enough to attract foreign investors who call for a number of economic and legislative reforms that would strengthen Egypt’s standing as a truly attractive investment destination.

Over the past few years, foreign and Arab investors interested in extending their businesses to Egypt were obliged to comply with the formal government exchange rate that only allowed them to sell their hard currency at Egyptian banks. Meanwhile, foreign currency was sold on the parallel market at a substantially higher exchange rate. This ambiguous policy and practice favored merchants who were free to deal with the parallel market while imposing significant constraints on the profitability of legitimate foreign direct investors.

Emerging countries such as Egypt need to intensify their economic efforts to attract more investors. The floatation of the Egyptian currency is an important and fundamental step in that direction, but it is neither adequate nor comprehensive enough to attract potential foreign investors. Bureaucracy, corruption, the inefficiency of our business structure and deficient legislation are only some of the many impediments that are preventing Egypt from becoming a truly competitive industrial market and an attractive tourism destination. Industry and tourism will benefit, to a certain degree, from the floating rate policy – but this move on its own is not sufficient.

Egyptian governments always assume that Egypt’s market competitiveness is limited to the provision of cheap products and services, which in fact has been our only competitive advantage for decades. Every now and then, the government tries (and rarely succeeds), in advancing and promoting other investment factors, but we continue to lag behind other countries in the region whose more efficient efforts allow them to rank ahead of us.

Political and economic forecasts

In the course of making foreign investment decisions for any given country, investors need to be able to make both political and economic forecasts for that country. In the case of Egypt, sadly, the political outlook is quite gloomy and the economic one is becoming more complicated, which results in delisting Egypt as an attractive country for investors.

Egypt ranks third among all the countries where the International Court of Arbitration has issued decisions upholding international investors at the expenses of governments. This indicates either that our business regulations and policies are not well articulated in the first place, or that consecutive Egyptian governments eventually change their minds (and business terms) in dealing with foreign investors, thereby awarding legal advantages to the investors. Additionally, our notorious deep bureaucracy, the difficulties we face in importing raw materials for manufacturing, and the obstacles affecting the transfer abroad of international investors’ profits have hindered our efforts to advance foreign direct investment in Egypt.

While the factors mentioned above disfavor Egypt as an emerging investment destination, the floatation of the Egyptian currency, along with the cheap cost of labor and our large population, work in our favor. The combined weight of all these factors has managed to attract a number of foreign investors who find Egypt to be an inexpensive location for producing products to be sold to its huge population – period. Meanwhile, it is becoming increasingly difficult for us to diversify our product exports, which are presently limited to a few agricultural products and ready-made garments.

Government messages and efforts that persist in promoting Egypt as a nation that offers cheap overheads and inexpensive tourist holidays will keep us eternally within the “invest less and realize less” bracket. Establishing Egypt as a prime destination for both investors and tourists will require addressing all of our challenges and introducing the needed reforms and adjustments to make Egypt a truly competitive nation. We have room to increase our national revenue significantly – on condition that we manage to provide better services, to reduce bureaucratic red tape substantially and to do away with corruption.

Latest News

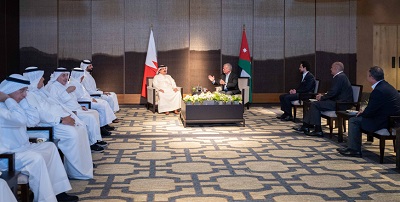

King, Bahrain monarch stress need to maintain Arab coordination

King, Bahrain monarch stress need to maintain Arab coordination Security Council to vote Thursday on Palestinian state UN membership

Security Council to vote Thursday on Palestinian state UN membership Dubai reels from floods chaos after record rains

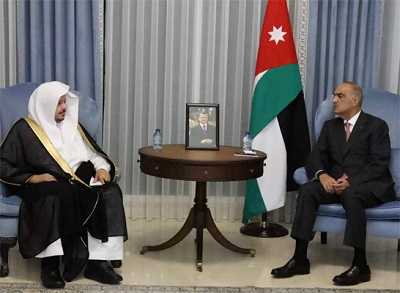

Dubai reels from floods chaos after record rains Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments

Khasawneh, Saudi Shura Council speaker discuss bilateral ties, regional developments Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Egyptian Foreign Minister condemns potential Palestinian displacement as 'war crime'

Most Read Articles

- Senate president, British ambassador discuss strategic partnership, regional stability

- Jordan urges UN to recognise Palestine as state

- JAF carries out seven more airdrops of aid into Gaza

- Temperatures to near 40 degree mark next week in Jordan

- Safadi, Iranian counterpart discuss war on Gaza, regional escalation

- UN chief warns Mideast on brink of ‘full-scale regional conflict’

- US vetoes Security Council resolution on full Palestinian UN membership

- Google fires 28 employees for protesting $1.2 billion cloud deal with “Israeli” army

- Biden urges Congress to pass 'pivotal' Ukraine, Israel war aid

- Israeli Occupation strike inside Iran responds to Tehran's provocation, reports say