Jordan's Economy in 2024: Firm Financial Stability - By Raad Mahmoud Al-Tal, The Jordan Times

The Central Bank of Jordan has issued the Financial Stability Report for the year 2024, aiming to provide a comprehensive assessment of the status of the financial sector and macroeconomic conditions in the Kingdom, while analyzing the risks and opportunities that may affect the stability of the financial system.

The report stated that the economy demonstrated high resilience and capability in maintaining macroeconomic stability, despite the rising state of geopolitical instability in the region due to the prolonged and unexpected continuation of the war on the Gaza Strip. Additionally, monetary and financial stability in the Kingdom remained strong, driven by the Central Bank’s prudent monetary and supervisory policies.

Financial stability refers to enhancing the ability of banks and various financial institutions to handle potential risks and minimize any structural imbalances that may impact the performance of the financial system.

The report highlighted that the banking sector in Jordan enjoys a high level of stability, with noticeable improvement in most of the financial ratios and indicators of banks. The capital adequacy ratio of the Jordanian banking sector rose to 18% by the end of June 2024, compared to 17.9% at the end of 2023, which is well above the minimum requirement of 12%, providing a comfortable buffer. Furthermore, the sector maintains safe liquidity levels that exceed the regulatory limits.

The report also pointed out that the ratio of non-performing loans (NPLs) in banks reached 5.8% at the end of last June, 71.3% of which are covered by provisions, indicating a sound risk management approach. It also explained that the results of stress testing showed that the banking sector is capable of withstanding high shocks and risks, due to the banks in Jordan maintaining high capital levels and comfortable liquidity and profitability ratios.

The Central Bank continues to implement the Green Finance Strategy (2023–2028), which it launched in 2023. This strategy is the first of its kind in the Middle East and North Africa region and serves as a roadmap to enable the Central Bank and the banking and financial sector to enhance green finance and reduce the risks of climate change.

The Central Bank also issued its first-ever instructions related to climate risks for banks operating in the Kingdom, titled "Climate Risk Management Instructions," with the goal of strengthening and activating climate risk management in the Jordanian banking sector.

Additionally, the Central Bank launched the second National Financial Inclusion Strategy (2023–2028) in March 2024. This strategy centers around enabling responsible and sustainable access to and usage of financial products and services for all segments of society. It contributes to achieving the goals of Jordan’s Economic Modernization Vision and promotes economic and social development across the Kingdom. The Central Bank has also continued to review the legislative and regulatory framework to align with the latest developments and international best practices regarding the role of central banks in ensuring monetary and financial stability.

In conclusion, despite regional and global challenges, the Jordanian economy once again proves its capacity for resilience and adaptability, supported by a stable monetary and banking environment. The findings of the Financial Stability Report confirm that Jordan is on a sound path, enhancing its economic strength and supporting its ambition to achieve sustainable and inclusive economic growth, even in the midst of a volatile regional environment.

Latest News

-

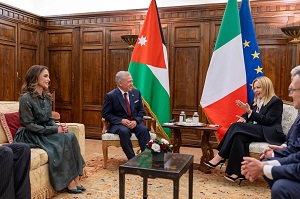

King, Italy PM call for ensuring implementation of Gaza agreement

King, Italy PM call for ensuring implementation of Gaza agreement

-

King, Queen meet with Pope Leo XIV

King, Queen meet with Pope Leo XIV

-

Russia accused of targeting UN aid convoy in southern Ukraine’s Kherson region

Russia accused of targeting UN aid convoy in southern Ukraine’s Kherson region

-

'Israel' won’t reopen Rafah crossing over Hamas’s failure to return captives’ bodies: Hebrew media

'Israel' won’t reopen Rafah crossing over Hamas’s failure to return captives’ bodies: Hebrew media

-

'Israel' returns 45 Palestinian bodies to Gaza as past organ theft allegations resurface

'Israel' returns 45 Palestinian bodies to Gaza as past organ theft allegations resurface