SSIF real estate portfolio hits JD1.1b in 2025, reaffirms transparency on land purchases

The Jordan Times

AMMAN — The Social Security Investment Fund (SSIF) affirmed its commitment to achieving transparency and institutional disclosure and presenting information about its investments within the proper time and investment context, following recent social media reports about land purchases made in previous years.

In a statement issued Thursday, the SSIF said investment decisions should be assessed against the economic conditions prevailing at the time and within its long-term investment approach.

The SSIF said its real estate portfolio stood at about JD1.1 billion at the end-2025, representing 6.2 per cent of total assets, and recording a net increase of around JD290 million over historical cost, based on preliminary end-2025 financial statements, the Jordan News Agency, Petra, reported.

The fund said it "regularly" discloses financial data and the performance of its investment portfolios, including real estate, adding that it issued a detailed official statement in 2019 on the purchase of a land parcel in the Western Railway Basin, Al Tunayb area, acquired in 2007.

The fund said the purchase was conducted in line with the procedures and authorisations in force at the time and at prevailing market prices, and was reviewed by relevant oversight bodies, including the Integrity and Anti-Corruption Commission.

The fund said its broader land and property acquisitions are executed under an approved investment policy, aimed at achieving asset diversification and strengthening the real estate portfolio, under institutional procedures that include independent valuations by accredited assessors and multi-level review and decision-making processes aligned with applicable mandates.

Real estate assets are subject to periodic independent valuations under recognised accounting frameworks, with any changes recorded in the financial statements, including book gains or losses reflecting market fluctuations.

It stressed that such accounting movements do not constitute realised losses unless an asset is disposed of, the fund pointed out.

The fund said decisions to develop or invest in land are based on economic feasibility studies that consider real estate market cycles, development costs and return, risk and sustainability benchmarks, with the objective of maximising returns for insured persons’ funds.

At the start of this year, the fund announced it posted "exceptional" performance, reporting a JD2.4 billion increase in assets to JD18.6 billion, up from JD16.2 billion at the start of the previous year, representing 15 per cent growth.

Meanwhile, comprehensive income rose to about JD2.2 billion at end-2025, up from about JD1.0 billion at end-2024, a gain of roughly 118 per cent, reflecting the fund’s financial strength and investment management performance, it added.

Latest News

-

Cabinet approves JD100m package to support public universities

Cabinet approves JD100m package to support public universities

-

US opposes West Bank annexation after Israel tightens grip

US opposes West Bank annexation after Israel tightens grip

-

UN force to withdraw most troops from Lebanon by mid 2027

UN force to withdraw most troops from Lebanon by mid 2027

-

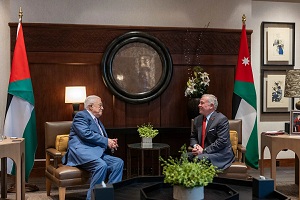

King receives Palestinian president, condemns illegal measures to entrench settlements

King receives Palestinian president, condemns illegal measures to entrench settlements

-

King attends Amman Chamber of Commerce celebration of over 100 years since its founding

King attends Amman Chamber of Commerce celebration of over 100 years since its founding