Moody’s, Fitch affirm Jordan’s rating again despite continued global uncertainty, downgrades

The Jordan Times

AMMAN — Moody’s Investors Service on Thursday affirmed Jordan’s B1 credit rating. The rating committee noted that, despite global and regional pressures, Jordan’s economic fundamentals, government strength, and fiscal and economic strength, have “not materially changed”, according to a statement from the global rating agency.

The Stable Outlook has been maintained due to Moody’s expectation that the general government debt of below 90 per cent of GDP will be the peak, owing to expenditure control, improvements in tax compliance and administration, and gradually improving growth dynamics.

The fall in Jordan’s tourism revenues has come after a period of significant improvement in Jordan's current account, and is expected to be offset with the recovery of global demand.

Despite the new wave of coronavirus cases, Moody’s commended the government’s continued momentum of a comprehensive economic reform agenda, which is expected to lift Jordan’s economic growth rate.

Building on these structural reforms, the new four-year International Monetary Fund EFF also contributed positively to Jordan’s rating, described as an “effective policy anchor”, aiming to stabilise the government’s debt-GDP ratio through a combination of expenditure controls, improvements in tax administration and tackling of tax evasion and avoidance, and enhancing efficiency of public spending.

Also on Thursday, Fitch Ratings Agency has again affirmed Jordan’s Long-Term sovereign credit rating at ‘BB-‘, citing Jordan’s “track record of gradual fiscal and economic reforms and resilient ability of domestic and external financing”.

The agency, in a statement, outlined that the decline in budget revenue due to economic contraction and targeted tax reliefs was partially mitigated, including further steps to improve income and GST tax collection.

Foreign reserves in the Central Bank of Jordan are described as robust, averaging coverage of over eight months of Current External Payments.

The rating agency maintained their same previous, cautioning of coronavirus and the impact that it may have on the budget deficit, government debt and net external debt.

The government, however, was commended for displaying the necessary “expenditure restraint”, which the Ministry of Finance has previously explained would be observed in non-essential areas with priority directed towards social safety nets, health-related expenditure, and pandemic-related stimulus.

Accordingly, although general government budget deficit is expected to widen in 2020 and General Government debt expected to widen to 89 per cent of GDP, this deficit is expected to gradually narrow to 2.6 per cent in 2022 as revenue recovers with the economy, pandemic-related tax reliefs, and the government maintains expenditure restraint.

Fitch Ratings also noted that key manufacturing industries were able to continue operating throughout the year, and that government sectors have also supported GDP.

The rating affirmation by Fitch and Moody’s follow another affirmation by Standard and Poor’s (S&P) in September. This comes in light of a series of credit rating downgrades to several economies with typically robust ratings due to the coronavirus pandemic, in continents ranging from North America to Africa and Asia.

Latest News

-

Syrian army says entering area east of Aleppo after Kurds agree to withdraw

Syrian army says entering area east of Aleppo after Kurds agree to withdraw

-

Sisi Says he Values Trump Offer to Mediate Egypt-Ethiopia Dispute on GERD

Sisi Says he Values Trump Offer to Mediate Egypt-Ethiopia Dispute on GERD

-

SDF pulls back from eastern Aleppo, consolidates east of Euphrates

SDF pulls back from eastern Aleppo, consolidates east of Euphrates

-

Washington Enhancing Military Presence in Middle East amid Iran Tensions

Washington Enhancing Military Presence in Middle East amid Iran Tensions

-

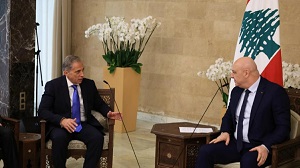

Hassan meets with President Aoun, reaffirms Jordan’s support for Lebanon

Hassan meets with President Aoun, reaffirms Jordan’s support for Lebanon