Arab Bank Group profits grow by 9.3% to $818.1m for first nine months of 2025

The Jordan Times

AMMAN — Arab Bank Group reported solid results for the first nine months of 2025, with 9.3 per cent increase in net income after tax reaching $818.1 million as compared with $748.6 million for the same period last year.

The Group maintained its strong capital base with a total equity of $12.9 billion, according to a bank statement.

This growth was fueled by higher activity in core banking operations and an expanded customer base in the Group’s key markets.

The Group’s Assets grew by 8.9 per cent to reach $76.8 billion, with a loan portfolio net growth by 8.6 per cent to $37 billion, and deposits grew by 8 per cent to reach $55.8 billion.

Commenting on the financial results, Chairman of Arab Bank Sabih Masri, stated that the "solid" performance achieved during the nine months of 2025 reflects the Group’s firm commitment to executing its long-term strategy, which is centered on sustainable growth and enhanced efficiency in liquidity, capital and risk management.

He stressed that these results demonstrate the Group’s strong ability to adapt to "evolving" economic conditions, navigate challenges and continue providing advanced banking solutions and services that meet the needs and expectations of its clients across diverse markets and operating environments.

Masri underscored the Group’s continued commitment to expanding its wealth management and private banking business, highlighting Arab Bank Switzerland’s recent merger of Gonet & Cie SA (Gonet) and ONE swiss bank SA (ONE) as a key step in consolidating its capabilities and enhancing client offerings.

He noted that the Group’s regional expansion also gained further momentum with the launch of its subsidiary’s operations in Iraq (Arab Bank Iraq) earlier this year, marking a significant milestone in the Group’s strategic growth journey and reinforcing its presence across key MENA markets.

Arab Bank’s Chief Executive Officer Randa Sadik, stressed that the Group’s wide geographic presence and diversified revenue streams played a "pivotal" role in supporting operational performance and delivering strong results despite challenges posed by the current economic environment.

She highlighted that the Group maintained solid levels of liquidity, with a loans-to-deposits ratio of 73.2 per cent, and continued to adopt a prudent credit policy, with credit provisions against non-performing loans above 100 per cent.

The Group maintains a strong capital base, primarily composed of core capital, with a capital adequacy ratio of 17.2 per cent, which is well above the minimum requirement set by the Central Bank of Jordan (CBJ).

Sadik also pointed out that Arab Bank Group continues its investments in digital and innovative banking solutions and services designed to enhance customer experience and support long-term growth.

She highlighted that these efforts ensure the Group remains well positioned to sustain its momentum and competitiveness amid the rapid transformation shaping the regional and global banking sector.

Latest News

-

BBC accused of doctoring Trump speech to suggest he incited Capitol riot

BBC accused of doctoring Trump speech to suggest he incited Capitol riot

-

UPS cargo plane crashes near Louisville airport

UPS cargo plane crashes near Louisville airport

-

Jordan, UK discuss strengthening ties and humanitarian efforts in Gaza

Jordan, UK discuss strengthening ties and humanitarian efforts in Gaza

-

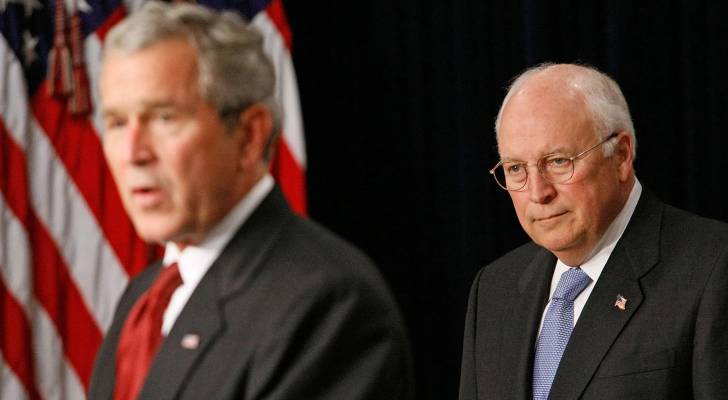

Former US vice president Dick Cheney, architect of Iraq War, dies at 84

Former US vice president Dick Cheney, architect of Iraq War, dies at 84

-

Qassam Brigades announce discovery of 'Israeli' soldier’s body in Gaza

Qassam Brigades announce discovery of 'Israeli' soldier’s body in Gaza