Central Bank cuts interest rates by 25 basis points

The Jordan Times

AMMAN — The Central Bank of Jordan (CBJ) announced on Thursday a 25-basis-point reduction in interest rates across all monetary policy instruments, effective November 2, 2025.

CBJ said in a statement that the reduction came in light of the assessment of recent economic, monetary, and financial developments, including trends in interest rates at the domestic, regional, and global levels.

Monetary and banking indicators have continued to show strong positive performance throughout the elapsed period of the year, the bank said.

The Central Bank said its foreign reserves reached an unprecedented level of $23.9 billion at the end of September 2025, sufficient to cover the Kingdom’s imports of goods and services for 9.1 months, equivalent to three times the internationally recognised standard, “reflecting the strength of monetary and banking stability in the Kingdom.”

The dollarisation rate declined to 17.9 per cent at the end of August 2025, while the inflation rate remained stable at around 2 per cent during the first three quarters of the current year, consistent with the Central Bank’s projections and this is expected to help preserve purchasing power and enhance the competitiveness of the national economy.

Total customer deposits with banks rose by 5.5 per cent year-on-year, reaching JD48.8 billion at the end of August 2025, while outstanding credit facilities granted by banks increased by 3.3 per cent to JD35.7 billion, according to CBJ.

Financial soundness indicators for banks, as of the end of the first half of the year, confirmed the robustness and stability of the Jordanian banking sector. The capital adequacy ratio stood at 18%, one of the highest in the region, alongside comfortable liquidity levels of 142.4 per cent, exceeding the Central Bank’s required ratio of 100 per cent.

Regarding balance of payments indicators, the bank said that the Kingdom’s tourism revenues increased by 6.8 per cent during the first three quarters of the current year to reach $6.0 billion, while workers’ remittances from abroad rose by 3.1% in the first eight months of the year, reaching $3.0 billion.

Similarly, the Kingdom’s total exports grew by 7.7 per cent during the first eight months of the year, reaching $9.5 billion. Net inflows of foreign direct investment into the Kingdom during the first half of 2025 rose to $1.0 billion, a growth of 36.4 per cent compared with the same period in 2024.

In light of these developments, the current account deficit declined in the first half of the year to 7.4 per cent of GDP, compared with 8.3 per cent during the corresponding period of 2024, supported by an 18.7 per cent increase in the services account surplus and a 42.1 per cent reduction in the investment income deficit.

On the economic growth front, the national economy recorded a 2.8 per cent growth rate in the second quarter, following a 2.7 per cent increase in the first quarter of the year.

The Central Bank of Jordan reaffirms its firm commitment to maintaining monetary and financial stability, in a manner that supports sustainable economic growth and overall macroeconomic stability in the Kingdom.

Latest News

-

BBC accused of doctoring Trump speech to suggest he incited Capitol riot

BBC accused of doctoring Trump speech to suggest he incited Capitol riot

-

UPS cargo plane crashes near Louisville airport

UPS cargo plane crashes near Louisville airport

-

Jordan, UK discuss strengthening ties and humanitarian efforts in Gaza

Jordan, UK discuss strengthening ties and humanitarian efforts in Gaza

-

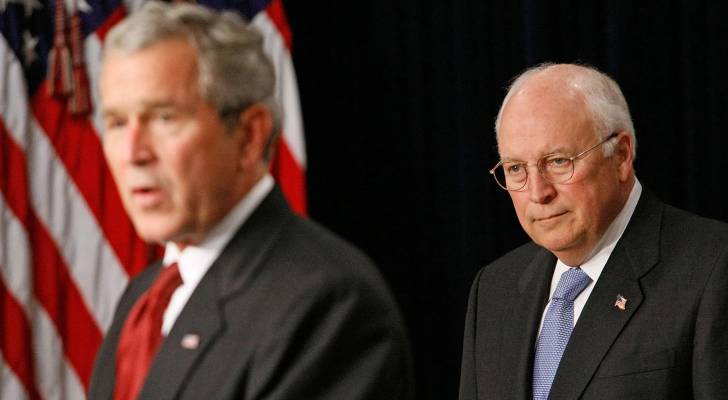

Former US vice president Dick Cheney, architect of Iraq War, dies at 84

Former US vice president Dick Cheney, architect of Iraq War, dies at 84

-

Qassam Brigades announce discovery of 'Israeli' soldier’s body in Gaza

Qassam Brigades announce discovery of 'Israeli' soldier’s body in Gaza