Debt-to-GDP ratio expected to drop under 83% due to year-end settlements — report

The Jordan Times

AMMAN — The Kingdom’s public debt declined by the end of 2025 despite a temporary increase recorded through November, when total debt reached around JD36.3 billion, equivalent to 83.2 per cent of estimated GDP for that year, according to preliminary fiscal data.

The data indicated that the public debt ratio is projected to fall to below 83 per cent of GDP by year-end, driven by the government’s repayment of Eurobonds maturing in June, part of the obligations due in January 2026, and the settlement of JD475 million in Treasury bills and bonds due in December 2025.

Officials said the scheduled repayments are expected to re-inject liquidity into the domestic economy, the Jordan News Agency, Petra, reported.

The temporary rise in the debt stock through November was attributed to financing the budget deficit, in addition to losses incurred by the National Electric Power Company (NEPCO) and the Water Authority of Jordan. It was also driven by the issuance of $700 million in Eurobonds at a yield of 5.75 per cent with a seven-year maturity.

According to the data, the Eurobond issuance was used to replace higher-cost debt with lower-cost borrowing, easing pressures on the public budget over the medium term.

Around $400 million in international bonds maturing in 2026 were repaid in November 2025, while the remaining proceeds from the new Eurobond issuance were deposited at the Central Bank of Jordan to cover the outstanding balance, which is expected to be settled during the current month, the officials said.

Latest News

-

Washington Enhancing Military Presence in Middle East amid Iran Tensions

Washington Enhancing Military Presence in Middle East amid Iran Tensions

-

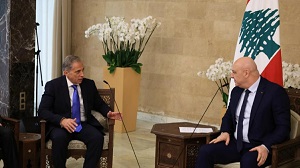

Hassan meets with President Aoun, reaffirms Jordan’s support for Lebanon

Hassan meets with President Aoun, reaffirms Jordan’s support for Lebanon

-

Iran protester not sentenced to death, Trump says to 'watch it and see'

Iran protester not sentenced to death, Trump says to 'watch it and see'

-

King receives Evangelical Lutheran Church delegation

King receives Evangelical Lutheran Church delegation

-

King receives Bosnia and Herzegovina FM

King receives Bosnia and Herzegovina FM