From hesitation to participation: Encouraging Jordanians to invest with confidence - By Zaid K. Maaytah , The Jordan Times

For many Jordanian families, conversations about money revolve around familiar habits: saving in bank accounts, buying a small piece of land if possible, or purchasing gold for security. These traditions have shaped financial behavior for generations and given people a sense of comfort and predictability. Yet in these same conversations, one option rarely appears even though it sits quietly at the heart of our economy: the Jordanian stock market.

For most people, the stock market feels distant, It is seen as a place reserved for experts or wealthy investors, not for ordinary families planning their future. Many worry about losing money, especially when savings are limited. Others feel the process is too complicated to understand. Some recall past economic turbulence in the region and assume that what was once unstable will always be so. And perhaps most importantly, most Jordanians simply did not grow up hearing relatives or friends talk about investing. When something isn’t part of everyday conversation, it rarely becomes part of everyday decisions.

These reactions are natural. People everywhere tend to avoid what feels unfamiliar or uncertain. But when these feelings become widespread, they end up closing the door on a tool that could genuinely strengthen long-term financial stability for many households.

This hesitation carries national implications. The stock market is more than a financial platform; it is one of the engines through which economies grow. When more Jordanians participate, even with small amounts, companies gain a stronger and more stable base of local support. They can plan, expand, and hire with greater confidence. A market supported by its own citizens becomes less sensitive to external shocks and more reflective of the real capabilities of the national economy.

Many countries have walked this path before. In Singapore, people once avoided investing because it felt distant from their daily routines, but this changed when saving programs made participation simple and nearly automatic. In South Korea, workplaces introduced contribution plans that allowed employees to invest small monthly amounts without paperwork. In Kenya, community groups gathered neighbors to learn about investing together, gradually turning the idea of owning shares into something normal and even social. These experiences show that when investing is made easy, familiar, and safe-feeling, people start to see it as a natural part of planning for the future.

Jordan can follow a similar path, guided not by imitation but by inspiration. The first step is simplicity. Opening an investment account should be as easy as opening a digital wallet. Clear instructions, streamlined steps, and user-friendly platforms can remove the anxiety that discourages newcomers, and the system should also welcome small beginnings. When people can start with modest amounts, the sense of risk becomes manageable, and the habit becomes easier to build.

Workplaces can play an active role as well; companies, universities, and public institutions could offer voluntary programs that allow employees to set aside small contributions each month. When saving and investing become routine rather than exceptional, participation grows naturally and without pressure.

Financial awareness matters too, but it must be presented through stories, not technical language. Workshops in schools, universities, and local community centers can explain the basics in simple terms. Short videos, radio programs, and social-media stories can highlight how ordinary Jordanians use investing to meet practical goals: funding education, preparing for retirement, or supporting national companies they already depend on.

The Amman Stock Exchange can also strengthen its presence outside the capital. Partnerships with governorates and municipalities, traveling workshops, and regional financial days could help build a national culture of confidence that reaches households from Irbid to Ma’an. When information travels beyond official buildings and becomes part of community life, participation expands.

Encouraging Jordanians to invest is not about urging families toward unnecessary risks. It is about widening the range of tools available to them. It is about giving citizens the opportunity to participate in the growth of companies they already know. Above all, it is about deepening the relationship between people and the economy that reflects their ambitions.

When Jordanians invest in their own market, even gradually and with modest amounts, they invest in themselves. They build habits of planning and confidence, asnd they help create an economy where opportunity is shared more broadly, where progress feels collective, and where every household has a place in shaping Jordan’s future.

Zaid K. Maaytah – Researcher in economics and behavioral policy

Latest News

-

Trump administration weighs sanctions on UNRWA: Reuters

Trump administration weighs sanctions on UNRWA: Reuters

-

Talks Fail on Transfer Mechanism for Syrian Prisoners in Lebanon

Talks Fail on Transfer Mechanism for Syrian Prisoners in Lebanon

-

King meets with retired brothers-in-arms from Special Forces

King meets with retired brothers-in-arms from Special Forces

-

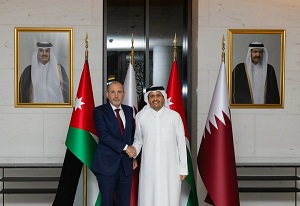

Foreign Minister, Qatari prime minister discuss bilateral ties, Gaza developments

Foreign Minister, Qatari prime minister discuss bilateral ties, Gaza developments

-

Jordan beats Egypt to reach 9 points at top of group C in Arab Cup

Jordan beats Egypt to reach 9 points at top of group C in Arab Cup