Oil falls as Trump allows China to buy Iranian oil

Roya News

Oil prices dropped sharply on Tuesday, hitting their lowest levels in two weeks, as markets responded to reduced fears of supply disruptions in the Middle East.

Brent crude futures fell USD3.52, or 4.92 Percent, to USD67.96 a barrel by 13:22 GMT, while US West Texas Intermediate (WTI) crude dropped USD3.42, or 4.99 Percent, to USD65.09. Both contracts lost nearly 5 Percent in early trading following US President Donald Trump’s announcement of a ceasefire deal between Israel and Iran.

However, hours after announcing the ceasefire, Trump accused both 'Israel' and Iran of violating the agreement, expressing particular frustration with Israel’s immediate retaliatory actions. “I didn’t like the fact that Israel unloaded right after we made the deal. They didn’t have to unload and I didn’t like the fact that the retaliation was very strong,” Trump told reporters.

Further weighing on prices, Trump also tweeted on the social media platform Truth Social that China can now resume purchasing oil from Iran, signaling a potential increase in supply.

The conflict, now in its 12th day, has caused significant volatility in oil markets. On Monday alone, Brent crude traded within an USD11.86 range, its widest since July 2022. The previous session saw both Brent and WTI settle more than 7 Percent lower after spiking to five-month highs, following US strikes on Iran’s nuclear facilities over the weekend.

Barclays commented that oil prices fell sharply as US attacks on Iranian nuclear sites failed to trigger a broader conflict that could threaten regional supply routes.

Investor focus remains on the Strait of Hormuz, a strategic chokepoint between Iran and Oman, through which roughly 18 to 19 million barrels of oil and fuels flow daily—nearly one-fifth of global consumption.

Latest News

-

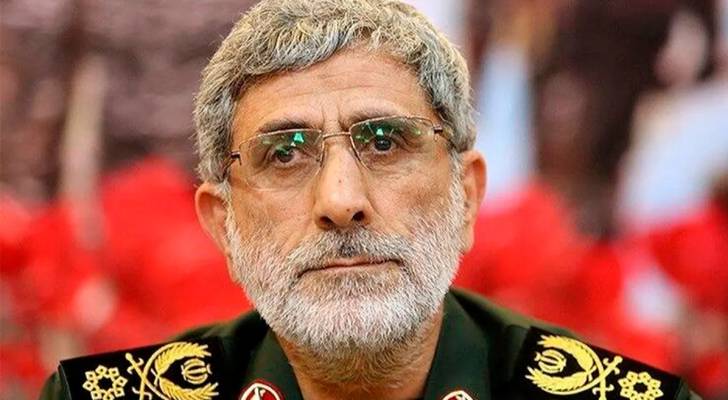

Still alive: Iran’s Quds Force commander Esmail Qaani appears after reports of assassination

Still alive: Iran’s Quds Force commander Esmail Qaani appears after reports of assassination

-

Oil falls as Trump allows China to buy Iranian oil

Oil falls as Trump allows China to buy Iranian oil

-

Ceasefire talks between Hamas, 'Israel' could resume within days: Qatar PM

Ceasefire talks between Hamas, 'Israel' could resume within days: Qatar PM

-

Trump: Israel is not going to attack Iran

Trump: Israel is not going to attack Iran

-

Trump Says Both Iran and Israel Violated a Ceasefire

Trump Says Both Iran and Israel Violated a Ceasefire